Get our rates or afixed-price quote!

"*" indicates required fields

Contact

K&C (Krusche & Company GmbH)

St.-Pauls-Platz 9

80336 Munich

Germany

A few of the partners we’re proud to be trusted by:

Done right, outsourcing can offer multiple strategic advantages. The increasing acceptance and prevalence of remote work is an additional tailwind in favour of outsourcing. Since the 1980s when it started to mainstream, the global outsourcing sector has developed into a stable and mature sector.

As the sector has evolved, so have the quality standards of services and processes. The client companies have also refined their way of approaching outsourcing. Especially IT outsourcing has also become an important source of innovation.

While IT outsourcers were once primarily tasked with executing processes, they are now increasingly involved in innovation and the business case and work as specialised, strategic partners alongside client companies.

Here we cover the latest data, facts and statistics relevant to the global outsourcing sector!

The global outsourcing market has grown steadily in recent years:

The value of the market is reflected, among other things, in the expenditure on outsourcing and shared services: In 2016, these were still USD 606.9 billion worldwide. In 2023, it is expected to increase to USD 971.2 billion. (Statista)

Between 2000 and 2019, the market value of outsourced services more than doubled from $45.6 trillion to $92.5 trillion. (Statista)

And despite the Corona pandemic and the Ukraine war, there is no obvious slowdown in the trend: According to a report by ReportLinker, the value of the outsourcing sector is expected to grow by USD 75.89 trillion between 2023 and 2027 at a compound annual growth rate (CAGR) of 6.5%. Similar figures are reported by Statista.

In business process outsourcing, a global market value of USD 350 billion is expected for 2023. By 2027, Statista forecasts a further increase to $450 billion, representing a compound annual growth rate (CAGR) of 6.48% between 2023 and 2027.

The average cost of an employee is expected to reach $100.50 in 2023. Most of the sales of business process outsourcing (BPO) are expected in the USA in a global comparison with USD 129.70 billion in 2023.

Source: Statista

Research and Markets’s 2022 sector report valued the global contract manufacturing market at USD 246.51 Billion in 2022, forecasting growth to USD 512.74 Billion by 2030 at a CAGR of 9.58 % from 2023-2030.

50% of companies surveyed by Deloitte’s Global Outsourcing Survey said they outsourced manufacturing and supply chain procurement.

Foxconn (Hon Hai Precision Industry), most famous as Apple’s outsourced iPhone manufacturer, is the world’s largest contract manufacturer, with a market capitalisation of $48.5 billion (as of June ’23).

Further strong growth is also predicted for the large segment of IT outsourcing. According to Statista, the sector’s market value is expected to reach $430.53 trillion in 2023 and rise to $587.3 trillion by 2027.

This represents a compound annual growth rate (CAGR) of 8.07% between 2023 and 2027, with most revenue expected to be generated in the U.S. ($156.20 billion in 2023). The average hourly cost for an employee in the IT outsourcing sector in 2023 is $123.60.

The three most important areas of IT outsourcing are administration/support outsourcing, application (development and maintenance) outsourcing and web hosting, these three together account for over half of the market value.

Source: Statista

The market value of administration outsourcing is expected to reach $60.21 billion in 2023. With a projected annual growth rate (CAGR) of 5.29% between 2023 and 2027, the market value is projected to reach USD 74.00 billion by 2027. The average spend for an employee in this segment is expected to be $17.28 in 2023. Most of the revenue will be generated in the USA in 2023 with USD 21,730.00 million.

The global app development outsourcing market is projected to grow from USD 122.67 trillion in 2023 to USD 145.73 trillion in 2027. That represents an increase of $23.1 trillion or a compound annual growth rate (CAGR) of 4.39%. The largest share of the market value will be generated in the USA (USD 44,350.00 million in 2023). The average hourly cost of app outsourcing workers is estimated to be $35.21 for 2023. (Statista)

The total global revenue from web hosting, i.e. the provision of web space and web servers, is expected to reach USD 90.42 billion in 2023. The compound growth rate (CAGR) is estimated to be 12.442% for 2023 – 2027. This would increase the market value to USD 144.40 billion in 2027, more than tripling compared to 2017. In a global comparison, most of the sales in 2023 will be generated in the USA, with an expected USD 32,450 million.

The Other IT Outsourcing segment combines all revenues that are not specifically mentioned in the other sub-segments (administration outsourcing, app outsourcing, web hosting). These include, for example, infrastructure outsourcing, network outsourcing and other IT-related outsourcing.

The market value in this sector is projected to be USD 157.16 billion in 2023. With a compound annual growth rate (CAGR) of 9.16% between 2023 and 2027, it is expected to reach $223.17 billion in 2017. Spending on an employee averages $45.11 an hour in 2023. Contributing $57,650.00 million, most of the revenue in 2023 is expected to be in the United States. (Statista)

According to Zippia, 59% of companies say cost savings are a reason for outsourcing. But can costs also be saved with nearshore outsourcing?

Nearshore outsourcing combines many advantages of onshore and offshore outsourcing: While onshore outsourcing, for example, is characterized by short distances and thus simplified communication, offshore providers often advertise considerable cost savings.

While software developers in the largest offshore markets, India and China, receive the lowest hourly wages, nearshore providers also offer significant savings compared to onshore companies, but at the same time they are more easily accessible than offshore alternatives and often even in the same time zone as the hiring company. For example, software architects, business analysts, and Scrum Masters cost about half as much as onshore in a nearshore market, but little more than offshore. (Hatchworks)

Source: Hatchworks

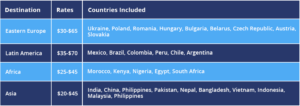

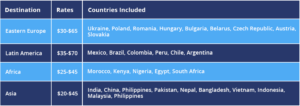

While in the last section we compared the average hourly wage between onshore, nearshore and offshore providers in different IT areas, we now want to take a closer look at the hourly wage in individual regions and countries.

In the US, an experienced software developer’s hourly wage is around $65-130 per hour. In the nearshore region of Eastern Europe, which is important for Central Europe, companies pay only about half: 30-65 USD / hour. Latin America – a major near- or offshore destination for North America – is in a similar range of $35-70/hour. In offshore regions such as Asia and Africa, the average hourly wage is between $20 and $45, which is still somewhat, but not necessarily much lower. (Griddynamics)

Source: Griddynamics

In Eastern Europe, Ukraine and Poland are among the most important outsourcing regions. In Ukraine, a developer earns an average of $ 30-60 / hour, with the salary of a junior software developer being significantly lower at $ 19-25 / hour. The situation is similar in Poland, where the average hourly wage of a software developer is between 20 and 75 USD.

Central and South America is the most important nearshore outsourcing market for the USA. Brazil has the largest market share here, where a software developer costs an average of 15-60 USD / hour, depending on region, experience and expertise. The situation is similar in Argentina, where the average hourly wage is between USD 35 and USD 50. A junior developer can be hired from as little as $13/hour, while senior developers tend to be on the higher side.

In the more distant offshore markets, India and China are the most important Asian representatives. In India, the hourly wage of a software developer is around $19 to $40/hour, very similar in China ($19 to $38/hour). Again, of course, the price varies depending on experience and expertise.

In Africa, Egypt and South Africa are the most important outsourcing destinations. In both countries, a software developer costs $25 to $45/hour, with a junior hiring as little as $18 (Egypt) or $21 (South Africa) per hour, while a senior’s hourly wage is closer to $50/hour. (Griddynamics)

The global market value in managed service outsourcing is expected to reach USD 22.54 billion in 2023. With an expected annual growth rate of 2.21% between 2023 and 2028, the market value for 2028 is estimated to be USD 25.14 billion. The average expense for an employee in 2023 is $6.48 an hour. In a global comparison, most sales in 2023 are expected in the USA (USD 9,032.00 million). (Statista)

The global trend towards outsourcing is also evident in the pharmaceutical industry. While in 2014 the outsourced market share was still 33.7%, an increase to 49.3% is expected for 2023. (Statista)

Over half (52%) of all companies use outsourcing for key business functions such as legal, tax, HR or finance. More than three-quarters (76%) of all executives say they outsource IT functions, including cybersecurity in first place, followed by app and software development and IT infrastructure services. (Deloitte Global Outsourcing Survey 2022)

Source: (Deloitte Global Outsourcing Survey 2022)

While 92% of G2000 enterprises use IT outsourcing, 37% of small companies use outsourcing for at least one business process. (Exploding Topics)

According to Clutch, in 2022, more than one in five small businesses (21%) planned to hire a nearshore outsourcing provider with outsourced functions and processes. In the U.S., approximately 300,000 jobs are outsourced each year (zippia).

Companies are also spending more and more money on outsourcing: In the 2022 Deloitte Global Outsourcing Survey, 67% of executives reported an increase in their operating services budget, 57% said they were spending more money on managed services, and 32% increased their budget on traditional outsourcing.

According to the Deloitte Global Outsourcing Survey 2022, one in two executives considers finding suitable specialists to be the biggest internal challenge in implementing corporate strategy. Directly behind this comes the challenge of limited data analysis tools and techniques.

Source: Deloitte Global Outsourcing Survey 2022

It is therefore not surprising that one of the most important reasons for the increasing investment in outsourcing is access to new opportunities (both technical and personnel): about half of the decision-makers cited this as the reason for the increasing use of Operate Services (49%), Managed Services (56%) and Traditional Outsourcing (49%).

Managed service models are considered a particularly important step towards digital transformation and technological modernisation: In addition to access to new opportunities, the two most important reasons for increasing usage are the increasing speed of digital transformation (62%) and increasing, increasingly complex cybersecurity threats (54%).

Cost savings also play an important role, especially in traditional outsourcing models: 57% of decision-makers cite cost savings as the reason for increasing usage (managed services: 33%; Operate Services: 40%).

(Deloitte Global Outsourcing Survey 2022)

According to Clutch, 27% of small businesses use outsourcing for IT services, followed by digital marketing (24%) and legal (23%).

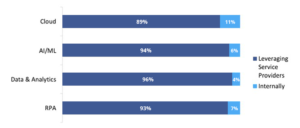

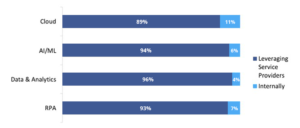

Cybersecurity is one of the biggest external challenges for companies, but only about half of the companies feel prepared for it. Hoping for support for this challenge, 81% of organizations are turning to third-party vendors. The use and development of technologies such as cloud (89%), AI/ML (94%), data analysis (96%) or RPA (Robot Process Automation, 93%) is also largely outsourced to third-party providers. (Deloitte Global Outsourcing Survey 2022)

Source: Deloitte Global Outsourcing Survey 2022

Of course, entrusting important business functions to a third-party provider, who may also be based in a more or less distant country, carries certain risks.

More than one in five CEOs surveyed by Deloitte fears negative influences on corporate culture when hiring outsourcing providers. In order to prevent negative experiences, transparency (54%), trustworthiness (41%) and understanding of the company’s business (40%) are the most important aspects for entrepreneurs. (Deloitte Global Outsourcing Survey 2022)

Of course, a good knowledge of English also plays an important role in global communication. The following graph from Statista shows the state of English proficiency in non-English-speaking countries.

Source: Statista

Globally, India is considered the number one offshore outsourcing destination for both the European and American markets, but is increasingly being challenged by nearshore outsourcing locations. According to a survey by Statista, India was the most attractive offshore outsourcing country in the world in 2021 (closely followed by China), with the financial attractiveness, expertise and availability of personnel playing a particularly important role.

For the U.S., South American countries such as Brazil are on the rise. Although some of them are several hours away by plane, they are increasingly characterized by tech talents with often good English language skills, increasingly better infrastructure, large overlaps of time zones and cultural similarities.

According to Bloomberg, 80% of North American companies are considering nearshore outsourcing. Brazil was already among the top 5 most attractive outsourcing countries in the world in 2021 (Statista), with over 28,000 companies in the software and IT sector (Statista). In addition to Brazil, the most attractive nearshore outsourcing markets for the USA at the moment are Mexico and Colombia (Statista).

For Europe, Southern and Eastern European countries in particular are attractive nearshore outsourcing locations, mainly due to significantly lower prices for highly qualified and reliable bilingual staff.

The value of the Southern European IT outsourcing market was USD 12.484 billion in 2020. Italy was the largest market with USD 6.257 billion, followed by Spain (USD 5.181 billion). Among Eastern European countries, Ukraine is the largest IT nearshore outsourcing location, with a market value of USD 4.5 billion. Other attractive Eastern European locations are Poland (USD 2.088 billion) and the Czech Republic (USD 1.016 billion). More than 200,000 IT specialists are currently working in Ukraine. By 2025, this number is expected to rise to 242,000. (Grid Dynamics)